- TAX IMPLICATIONS OF WORKING REMOTELY FROM ANOTHER STATE FOR FREE

- TAX IMPLICATIONS OF WORKING REMOTELY FROM ANOTHER STATE PRO

- TAX IMPLICATIONS OF WORKING REMOTELY FROM ANOTHER STATE PROFESSIONAL

TAX IMPLICATIONS OF WORKING REMOTELY FROM ANOTHER STATE FOR FREE

Click here to read our full review for free and apply in just 2 minutes. In fact, this card is so good that our credit card expert even uses it personally. Plus, this pick packs in an insane cash back rate of up to 5% with no annual fee. Offer from the Motley Fool: Our in-house credit card expert loves this top credit card pick, which features a 0% intro APR until 2023 that can help you avoid interest charges on new purchases or pay off debt faster using simple balance transfer strategies.

TAX IMPLICATIONS OF WORKING REMOTELY FROM ANOTHER STATE PRO

SOMETIMES IT PAYS TO HIRE HELP: 5 cases where you should hire a pro to do your taxes Earn up to 5% back and wipe out interest until 2023

Rather than attempt to work through the rules yourself, enlist the help of someone who can guide you through the process and make sure you're filing the right returns. But in some cases, it could create a tax headache. Working remotely certainly has its benefits, and it's an option that's allowed many people to pad their savings due to not having to spend money on commuting.

TAX IMPLICATIONS OF WORKING REMOTELY FROM ANOTHER STATE PROFESSIONAL

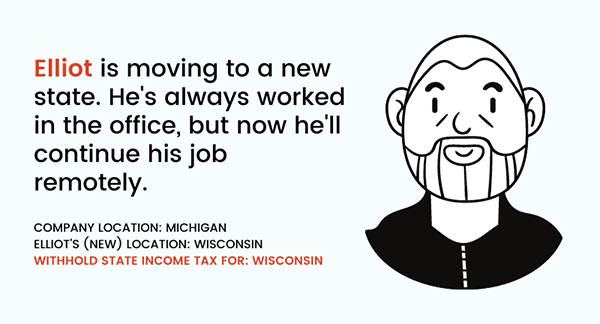

But if you spent a significant amount of time working remotely in a state other than your home state, then it's probably best to consult an accountant or tax professional to get advice. If you worked remotely last year but did so from a single state, then you don't have to worry about this complex issue. TAXES 2022: 5 things you may not realize are tax-deductible Get help if the situation is murky There are also a number of states that don't impose a tax liability if you specifically work in a neighboring state. It all depends on the states in question and what their respective tax rates are. But that credit may not fully offset the amount you need to pay to the second state you lived or worked in. Most states offer a tax credit that offsets your liability if you're not a resident there. But working in two states could create an extra tax liability for you. One thing you need to know – before you panic – is you can't be taxed double on your income just because you did your job from two states. But if you worked for three months in a different state, you may have to file a separate return.

So if you live in Pennsylvania, for example, you can bank on having to file a Pennsylvania tax return for 2021. Of course, no matter what, you're generally required to file a tax return in the state you live in. SUBSCRIBE TO OUR NEWSLETTER: The Daily Money delivers our top personal finance stories to your inbox If you worked in more than one state in 2021, you may want to consult a tax professional to know what you're dealing with. Some states allow non-residents to work locally for a certain amount of time without creating a state tax liability or need to file a return. That's because different states have different rules. The problem, however, is that determining whether you need to file another state tax return can be complicated. But you may also be required to file more than one state tax return. Regardless of where you worked last year, you need to file a federal tax return. How many tax returns do you need to file? Either way, the place you did your job could impact your taxes, so as you gear up to file a return for 2021, you'll need to make sure you know the rules that apply to you. It may be the case that you did your job from another state for part of 2021 – say, to try it out or enjoy a number of months with different scenery and a more favorable climate.

But that doesn't necessarily mean they've been working from home. Many people have been working remotely since the start of the pandemic.

0 kommentar(er)

0 kommentar(er)